Difference Between Fee And Brokerage 5 Differences!

Being conscious of what brokerage costs are and tips on how to broker fees calculate brokerage is important for making informed investment choices. These fees, which range based on the sort of broker and the buying and selling model used, can significantly impact your general returns. By familiarising yourself with how these expenses are calculated and what elements influence them, you’ll find a way to better manage your buying and selling bills and choose probably the most appropriate brokerage mannequin on your funding technique.

What Are The Brokerage Costs For Futures?

You may find some brokers who’re exceptions to this, in that they cost payment solely once, for both the shopping for or selling. The commission formulation can be calculated by multiplying the number of shares purchased or offered by the value per share and then by the commission share. This determines the entire fee charged by a dealer for executing the trade. In the monetary securities industry, a brokerage payment is charged to facilitate buying and selling or to administer funding or other accounts.

What’s The Minimum Brokerage Charge?

However, we also have an offline facility, in case you wish to place your trade over name. The square-off costs for all of the squared-off are ₹20 + GST of 18%. Before doing something related to the bottom demat account costs, make sure to realize more information about it.

Top 5 Brokers With The Bottom Brokerage Costs 2024

Brokerage is a fee (usually in percentage) charged on the entire trade worth. These costs are levied on putting order/trade (total value) and is deducted from the portfolio. Clients / buyers are requested to chorus from dealing in any schemes of unauthorised collective investments / portfolio administration, indicative / assured / mounted returns / funds etc. With this, you must now be conscious of the brokerage calculation formula and the methods that you ought to use to minimize your trading costs. Now, you will need to do not neglect that the cost-effective option may not always be the solely option. Instead, the best brokerage mannequin ought to steadiness cost-effectiveness along with your particular buying and selling needs and investment goals.

Key Options Of Low Cost Brokers

- The brokerage calculator additionally offers the investor sufficient data to match opponents’ prices.

- It estimates all the trading charges, such as customs duty, GST, STT, etc.

- These fees, which vary based on the kind of broker and the trading model used, can significantly influence your total returns.

- One of the main costs that you have to bear is the brokerage charge that you just pay to your stockbroker for executing your trades.

It’s sometimes a set fee or a share of the transaction worth, various by broker and transaction sort. In monetary services, commissions are charged by brokers and monetary advisors for executing trades or providing investment recommendation. This charge construction aligns the broker’s or advisor’s pursuits with the client’s, as they earn extra after they facilitate extra transactions or handle bigger funding portfolios. Understanding brokerage expenses is a crucial aspect of profitable stock buying and selling in India. These charges can significantly influence your trading costs and total profitability.

Please note that by submitting the above mentioned particulars, you may be authorizing us to Call/SMS you despite the very fact that you may be registered beneath DND. The price of brokerage that’s effectively charged is completely different from the chances talked about above. Besides brokerage, there are different related expenses that you simply additionally want to contemplate. If you’re wondering the method to calculate brokerage in share market, this instance will make it simpler to know.

You must pay a charge to the inventory trading platform to purchase and promote shares via them, and the cost refers to as the “brokerage.” Moreover, brokerage companies prolong beyond mere transaction execution. Brokers often provide useful market analysis, investment advice, and buying and selling platforms. For these additional companies, some brokers may charge larger charges, balancing value with the standard and vary of companies provided to their clients. They symbolize the fees traders pay to brokerage companies in trade for their services and entry to the financial markets. These costs can considerably impression an investor’s returns and general profitability.

Understanding Brokerage Expenses

This makes the process of buying and selling seamless and efficient for your buying and selling journey.

Usually, full-service stockbrokers are inclined to adopt a percentage-based mannequin. This is because the operational prices of full-service brokers are often very high, and the one approach to recuperate their prices is to levy brokerage as a proportion of the total commerce value. You can get financial savings through the use of a discount broker if you’re a self-directed investor or trader.

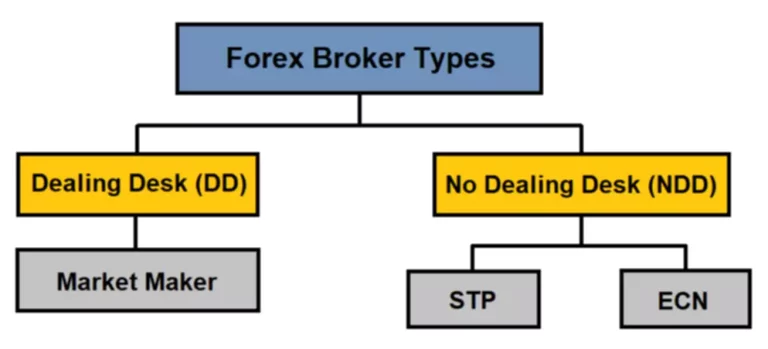

” We acquire, retain, and use your contact info for reliable business functions only, to contact you and to provide you information & newest updates relating to our products & companies.” Explore India’s rising EV market and prime shares like Tata Motors, Mahindra & Mahindra, Hero MotoCorp, Bajaj Auto, and extra. Your complete unbundled commission willinclude IB unbundled fees, plus exchange/ECN, clearing, and regulatory fees.

Trusted by over 2 Cr+ purchasers, Angel One is certainly one of India’s leadingretail full-service broking houses. We offer a variety of innovativeservices, including on-line buying and selling and investing, advisory, margin tradingfacility, algorithmic trading, good orders, and so on. Our Super App is apowerhouse of cutting-edge tools corresponding to basket orders, GTT orders,SmartAPI, superior charts and others that assist you to navigate capitalmarkets like a professional. For occasion, if you purchase one hundred shares at a price of Rs. 50 each, and the brokerage share is zero.5%, the brokerage fee is calculated by multiplying 100 shares by Rs. 50, then multiplying by 0.5%. An online stockbroker, typically known as a direct entry stockbroker, offers providers to lively day merchants at the lowest possible fee — usually on a per-stock basis.

Read more about https://www.xcritical.in/ here.